Week of 11th of March

Weekend Analysis

Please see below my weekly analysis, where I capture my readings on where the market is, key sectors that I am bullish on and the Top 50 stocks from last week. My intent with this analysis is to be on the right side of the market and make a disciplined approach to market.

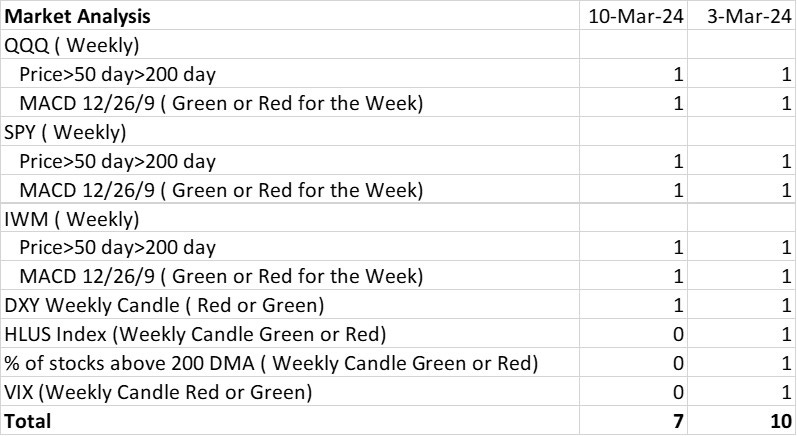

As mentioned last week, my market analysis tells me whether the market is overheated, normal or bearish.

Any Score above 7 means market is overheated and I won’t deploy more capital.

A score of 4-6 means that the market is normal, and I would check for opportunities to deploy capital or add/change my existing positions.

Anything less than 3 means market is in bearish Zone. When in bearish zone, I would go for great stocks at reasonable valuation only.

These states are fluid and may significantly change week to week. This analysis helps me in having a framework to deploy capital.

For the week of 17th March 2024 (11th March to 16th March), below is my market analysis.

The market score of 8 indicates that market is moving sideways and therefore a time-based correction is on cards. This is good for long term investments and indicates that market will reward investors who are patient. The current score is 8, it falls in category 1 above and therefore I would not add/change additional capital to my portfolio.

My activities last week: No change in overall portfolio. No add/sell to any of the stocks.

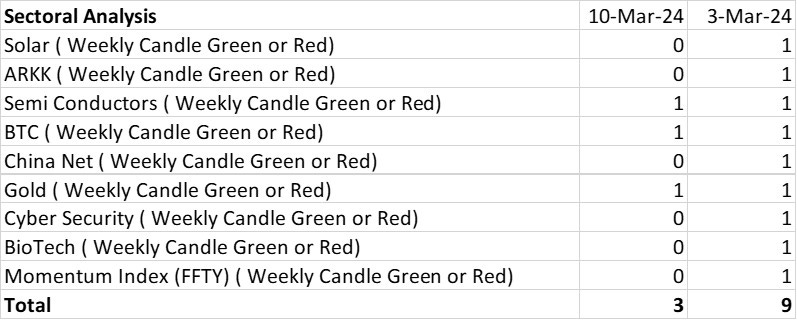

The Sector Analysis for the week is as below.

The score came down from 3 to 1. Since the market is moving sideways so this is expected. However, a word of caution that there is a divergence in score for overall market and sectors. Therefore, either the sectors or the market score should improve. While looking at the charts of these ETFs, following are my observations:

Solar stocks: The sector seems to be forming a base and will remain choppy in coming days. Overall, it looks like in consolidation phase. If the overall market sentiment improves and the rate cuts happen in future, then this sector will be one of the first ones to fly.

Growth Stocks: As mentioned last couple of weeks ARKK seems to be in an early Stage 2. The ETF did nothing wrong last week and continues to be so.

Semi-Conductors: As I had mentioned last week correction and sideways move are good if the overall sector is in a very long-term bull zone. This sector seems to have lost some momentum and time will tell whether we still have energy to push this sector further up. Currently I am on sidelines.

Bitcoin: As I had mentioned last week there could be some cool off in coming days. The correction last week was therefore no surprise for me. I am slowly nibbling in this crypto market aiming to build some positions for future.

China Net: This sector continues to consolidate sideways. This could go either way.

Gold: In line with my commentary, Gold had a major breakout when it closed at 2000 USD, and it seems to have continued in that bullish trade. Pls do remember that most of the investors including me invest in Gold to reduce portfolio volatility and ride over uncertainty.

Cyber security: This space needs some direction and that might come with overall market & economics condition. Now I am on sideways waiting for a direction to take a position.

Biotech: This sector also seems to be wanting to go down. I am not bullish in this space currently; however, I have no intention to short also. Most likely I will remain outside waiting for direction.

Momentum stocks: This space seems to be doing nothing wrong. Looks like the stocks in this ETF wants to go higher but the overall market conditions is not allowing them to flourish.

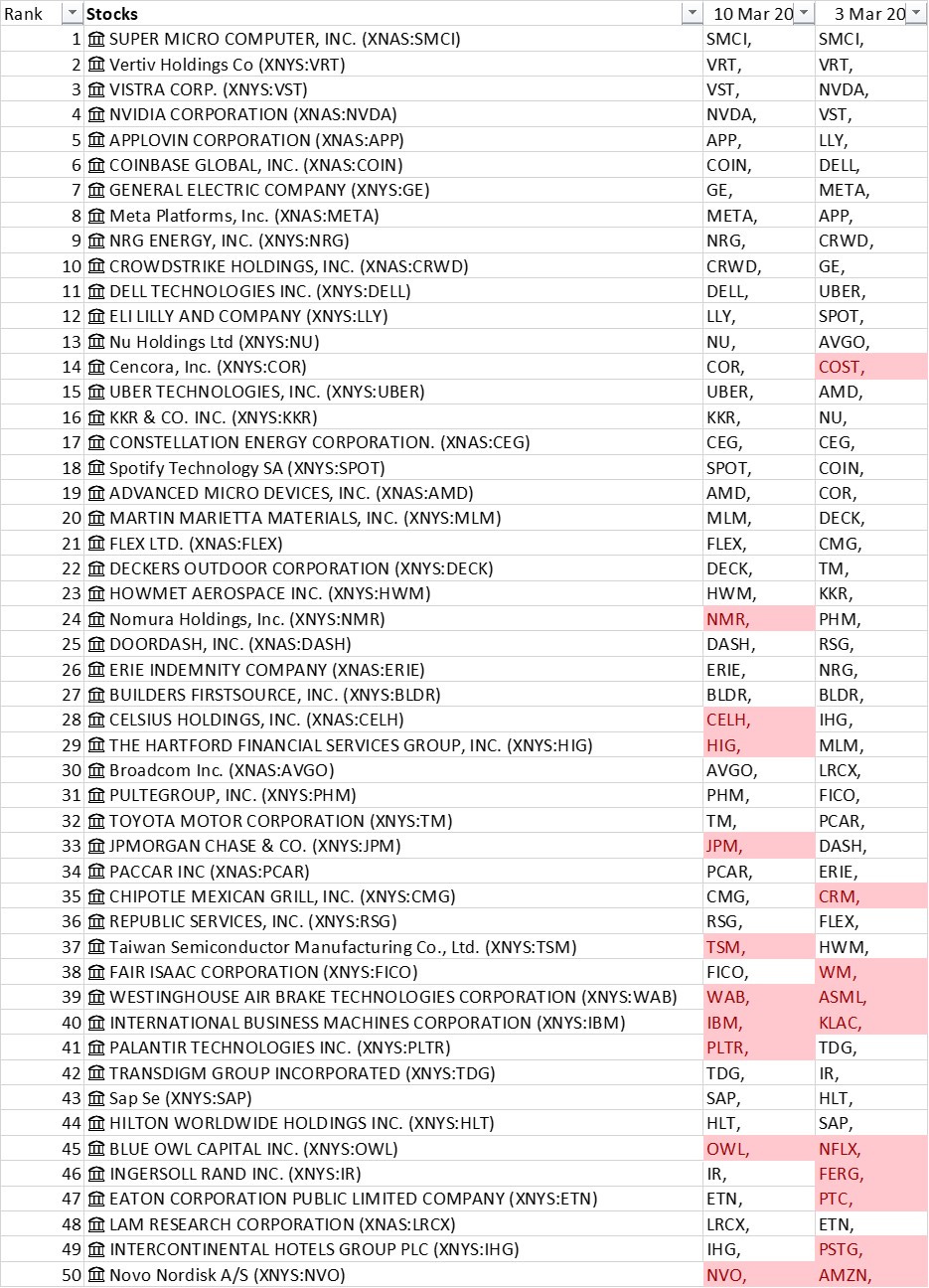

The List of Top 50 stocks for the week is as below.

Now as next steps, I would look changes in the two list above (highlighted in Red). I would investigate the outlook, valuation, and other aspects to identify the stocks & their respective price points at which I would add the stocks to my portfolio.

Why only stocks highlighted in Red: I like to enter a stock that is in late Stage 1 or early Stage 2. Therefore, the new entrants in Top 50 gives me a sense of which stocks could go in Stage 2 and gives me options to invest. The stocks leaving Top 50 from previous week gives me list of stocks which had failed Stage 2 move and could be the stocks to exit. However, my entry and exit criteria are not solely based on stage1/stage 2. I also look at valuation and outlook for specific stocks. This improves my overall conviction to enter/ exit stock. I could miss out on significant movements in some stocks due to this process, but overall, I am fine since I don’t want to own stocks without any conviction and my process helps me define/attain this convection to own/exit stocks.

My stock universe is about 732 stocks (Top stocks by market cap excluding stocks with bad experience in past).

Some Questions to readers

Pls share your feedback on my weekly analysis and if you find it useful.

Do let me know if you want to me to cover something more.

If you want to know my personal portfolio, then you can follow me on twitter/X at @TheGoldFinger2. I publish my portfolio holdings and changes on a weekly basis. You can also share your feedback on the content there.

I hope this gives an overview on my thought process for the week and my plan of action for the week. Once again this is not an investment advice. The article and the references below are for educational purpose only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.